Professional Assistance With Your Tax-Related Legal Needs

All too often, individuals and businesses only seek the informed guidance and assistance of our experienced Bethesda, MD tax lawyer when something has gone terribly wrong. While our dedicated team of legal professionals at Crepeau Mourges is always available to advocate aggressively on behalf of your interests if something has gone wrong, it’s critically important to understand that we can assist you in a proactive capacity as well, given that the best protection against unnecessary tax liability and preventable tax challenges is strategic foresight. Contact our Maryland firm today to discuss your tax concerns and learn how we can help.

How Our Tax Lawyer Can Help You

There are a host of reasons why you may benefit from connecting with our skilled Bethesda tax lawyer, either proactively or reactively. This is partially due to the reality that few areas of the law are as intricate, applied uniquely based on individual circumstances, and ever-evolving as the U.S. Tax Code. Trying to navigate a matter on your own could cost you time, money, and possibly even your freedom in the event that you’re charged with fraud, evasion, or other misconduct. Instead of risking potentially life-altering negative consequences, it’s generally best to seek legal guidance from our skilled tax lawyer when you’re facing fraud or any other tax-related challenges as an individual or as a business owner.

Tax-Related Services That You May Benefit From

Tax lawyers serve as specialists in the area of tax law, allowing clients to benefit from informed guidance and assistance. Some tax services that tax attorneys offer benefit clients in both proactive and reactive capacities. For example, a professional’s ability to interpret tax laws and regulations in informed ways can help to prevent legal challenges and can help to successfully resolve any that may arise. Similarly, tax planning and strategy can help to minimize tax liability before the IRS “comes knocking” and can help those who have been affected by IRS action to better safeguard their rights and interests moving forward.

Additionally, tax lawyers represent their clients’ interests in the event that legal action and/or audits are initiated against them as individuals or against their businesses. Navigating a legal dispute on one’s own may be fine if you unintentionally ran a red light or forgot to renew a professional license for a month. But representing yourself in a tax matter is almost certainly a recipe for both stress and negative consequences that are best avoided.

Help Identifying Self-Employed Business Tax Deductions

Our Bethesda, MD tax lawyer knows that managing taxes as a self-employed individual can be challenging, especially when it comes to recognizing legitimate deductions that reduce your tax liability. Tax laws frequently change, and many business owners may overlook deductions they’re eligible for, leaving money on the table. That’s where working with our tax lawyer can make a significant difference. Instead of being a general law firm with many specialties, we focus on things such as taxes, business, and estates. We work closely with self-employed professionals to help identify deductions that align with their specific business activities while staying compliant with tax regulations.

Recognizing Deductions Beyond The Basics

Self-employed individuals often think of common deductions, such as office supplies or home office expenses, but there’s a broader range of deductible costs. Business travel, professional memberships, equipment depreciation, and training expenses are just a few examples. Our tax lawyer evaluates how your business operates and identifies deductions you may not have realized apply to your situation.

For instance, some clients don’t recognize the potential to deduct expenses tied to promoting their business, such as website hosting fees, digital marketing campaigns, or industry-specific tools. Others might miss opportunities to claim vehicle-related expenses if they use a car for work. We work to uncover these opportunities and document them properly, so you benefit without raising red flags with the IRS.

Clarifying Business Vs. Personal Expenses

Our tax lawyer in Bethesda understands that a common area of confusion is distinguishing between business and personal expenses. For example, meals with clients may qualify as deductible, but only under certain conditions. Our tax lawyer helps define these boundaries, ensuring you don’t overclaim or underclaim in this category. Similarly, expenses that overlap between personal and business use—like a portion of your home’s internet bill—can be partially deducted. These distinctions can be complicated, but proper guidance helps you avoid costly mistakes.

Structuring Deductions For Maximum Impact

Self-employed taxes are calculated differently from those of traditional employees. In addition to income tax, you’re also responsible for self-employment tax, which includes Social Security and Medicare contributions. Every deduction you claim directly reduces your taxable income, which in turn lowers these additional tax burdens.

We look for opportunities to group deductions in ways that provide the most benefit. For instance, timing expenses in specific tax years can sometimes yield better results. This strategic approach ensures you’re making the most of every allowable deduction without stepping outside legal limits.

Staying Updated On Tax Code Changes

Tax regulations are subject to change, and what qualifies as a deduction one year might not qualify the next. Working with our tax lawyer means having someone who monitors these changes and assesses how they impact your business. This is particularly helpful for self-employed individuals who may not have the time or resources to stay informed about recent updates in tax law.

Let’s Find Your Savings

If you’re self-employed and want to maximize your tax deductions while staying compliant, the team at Crepeau Mourges is ready to assist. We take the time to understand your business, identify potential deductions, and create a strategy tailored to your financial goals. When you work with our firm, we will focus our attention entirely on you to efficiently resolve your needs. Contact our Bethesda tax lawyer today to schedule a consultation and learn how we can support you in building a stronger financial foundation for your business.

7 Steps to Creating a Small Business Tax Strategy

Our Bethesda, MD tax lawyer knows that developing a tax strategy is essential for small business owners who want to minimize tax liabilities while staying compliant with legal requirements. A well-thought-out approach helps protect your business finances and positions you for long-term success. We are a veteran-owned law firm and care about helping you with your tax needs. We work with business owners to create customized tax strategies tailored to their specific goals. Here are some key steps to help guide your planning process.

- Choose The Right Business Structure

Your business structure affects how you are taxed. Sole proprietorships, partnerships, LLCs, S-corporations, and C-corporations each have different tax obligations and benefits. For example, an LLC provides flexibility, while an S-corporation may reduce self-employment taxes. We assess which structure works best for your current and future needs.

- Track All Income And Expenses Accurately

Our tax lawyer in Bethesda can tell you that proper recordkeeping is the foundation of any tax strategy. Use accounting software to categorize business income and expenses, and keep receipts for all deductible costs. Tracking everything in real-time helps you avoid missing potential write-offs at tax time.

- Plan For Estimated Tax Payments

Small business owners often need to pay quarterly estimated taxes. Calculating these payments based on projected income prevents unexpected bills during tax season and reduces the risk of penalties. We can help you determine the right amount to pay each quarter based on your cash flow and expected earnings.

- Maximize Available Deductions

Deductions can significantly lower your taxable income. Common deductions include office expenses, advertising costs, travel, and employee benefits. However, the eligibility rules vary depending on the expense. We identify deductible items specific to your industry and help you structure expenses to take full advantage of what’s available.

- Consider Retirement Contributions

Setting up a retirement plan, such as a SEP IRA or solo 401(k), benefits both your financial future and your tax strategy. Contributions to these accounts are typically tax-deductible and can help reduce your taxable income. This approach works especially well for self-employed individuals looking for additional savings opportunities.

- Take Advantage Of Depreciation

If you purchase equipment, vehicles, or property for your business, you can deduct depreciation over time. Accelerated depreciation methods, like Section 179, allow you to claim a larger deduction upfront. Understanding when to use these options helps you align deductions with years where your tax liability is higher.

- Stay Current On Tax Law Changes

Tax laws frequently change, affecting deductions, credits, and filing requirements. Staying informed about these changes allows you to adjust your strategy as needed. For instance, recent legislation may offer new tax credits for hiring employees or investing in energy-efficient equipment.

Bethesda Tax Law Infographic

Bethesda Tax Law Statistics

According to national statistics, the IRS processes approximately 5.5 million Form 1065 returns, which are filed by partnerships, a common structure for small businesses. It processes another 4.5 million Form 1120-S returns filed by S corporations, another prevalent form for small businesses. To ensure your business is tax compliant, call our Bethesda tax lawyer for assistance.

Bethesda Tax Law FAQs

For business owners, it’s critical that they have a basic understanding of tax law, which is why it’s imperative to have help from our Bethesda tax lawyer. Our team is here to provide clarity and guidance on frequently asked questions related to business taxation. In this guide, we’ll cover essential topics such as types of business taxes, tax classification, deductible expenses, implications of hiring employees versus independent contractors, and calculating estimated taxes. Let’s dive in.

What Are The Different Types Of Business Taxes?

Business taxes encompass various types, including income taxes, payroll taxes, sales taxes, and excise taxes. Income taxes are levied on the profits earned by businesses, while payroll taxes are withheld from employee wages to fund Social Security and Medicare. Sales taxes are imposed on the sale of goods and services, varying by state and locality. Excise taxes apply to specific products like gasoline, alcohol, and tobacco.

How Do I Determine My Business’s Tax Classification?

The tax classification of your business depends on its legal structure. Common classifications include sole proprietorship, partnership, corporation, and S corporation. Sole proprietorships and partnerships pass through profits and losses to the owners, who report them on their personal tax returns. Corporations are separate legal entities taxed at the corporate level, while S corporations elect to pass income, losses, deductions, and credits through to shareholders for federal tax purposes.

What Expenses Can I Deduct As A Business?

In an effort to reduce their taxable income, business owners can deduct various expenses. Common deductible expenses include salaries and wages, rent for business premises, utilities, office supplies, advertising and marketing costs, professional fees, insurance premiums, and depreciation on business assets. It’s essential to keep detailed records and ensure that expenses are ordinary and necessary for your business operations.

What Are The Tax Implications Of Hiring Employees Versus Independent Contractors?

Our Bethesda tax lawyer will share that hiring employees entails payroll tax obligations, including Social Security, Medicare, federal and state unemployment taxes, and possibly workers’ compensation insurance. Employers must withhold income taxes and pay employer taxes on behalf of employees. In contrast, independent contractors are responsible for their taxes, and businesses generally don’t withhold taxes from their payments. Misclassifying workers can lead to penalties, so it’s crucial to understand the distinctions between employees and independent contractors.

How Do I Calculate And Pay Estimated Taxes For My Business?

Businesses typically pay estimated taxes quarterly to cover income and self-employment taxes. To calculate estimated taxes, estimate your business’s annual income and deductions, then calculate the tax liability based on the applicable tax rates. Use IRS Form 1040-ES to estimate and pay taxes quarterly. Failure to pay estimated taxes timely may result in penalties and interest. Consulting with a tax professional can help ensure accurate calculations and compliance with tax obligations.

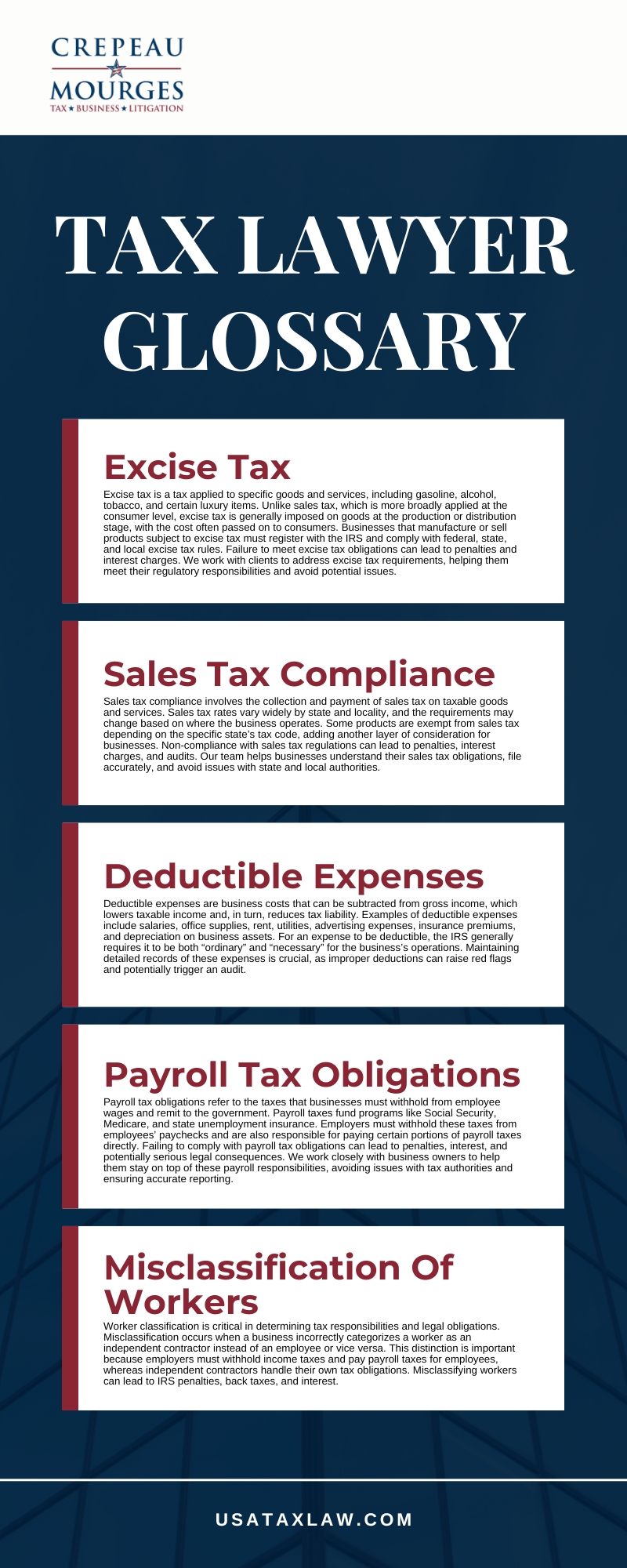

Bethesda Tax Lawyer Glossary

At Crepeau Mourges, our tax lawyers in Bethesda, MD, provide support for individuals and businesses dealing with various tax obligations and regulatory requirements. Below, we define some essential tax terms and concepts that can help clients understand the landscape of business tax compliance and individual tax responsibilities.

Excise Tax

Excise tax is a tax applied to specific goods and services, including gasoline, alcohol, tobacco, and certain luxury items. Unlike sales tax, which is more broadly applied at the consumer level, excise tax is generally imposed on goods at the production or distribution stage, with the cost often passed on to consumers. Businesses that manufacture or sell products subject to excise tax must register with the IRS and comply with federal, state, and local excise tax rules. Failure to meet excise tax obligations can lead to penalties and interest charges. We work with clients to address excise tax requirements, helping them meet their regulatory responsibilities and avoid potential issues.

Sales Tax Compliance

Sales tax compliance involves the collection and payment of sales tax on taxable goods and services. Sales tax rates vary widely by state and locality, and the requirements may change based on where the business operates. Some products are exempt from sales tax depending on the specific state’s tax code, adding another layer of consideration for businesses. Non-compliance with sales tax regulations can lead to penalties, interest charges, and audits. Our team helps businesses understand their sales tax obligations, file accurately, and avoid issues with state and local authorities.

Deductible Expenses

Deductible expenses are business costs that can be subtracted from gross income, which lowers taxable income and, in turn, reduces tax liability. Examples of deductible expenses include salaries, office supplies, rent, utilities, advertising expenses, insurance premiums, and depreciation on business assets. For an expense to be deductible, the IRS generally requires it to be both “ordinary” and “necessary” for the business’s operations. Maintaining detailed records of these expenses is crucial, as improper deductions can raise red flags and potentially trigger an audit. We assist clients in identifying eligible expenses to maximize tax benefits while maintaining compliance with IRS standards.

Payroll Tax Obligations

Payroll tax obligations refer to the taxes that businesses must withhold from employee wages and remit to the government. Payroll taxes fund programs like Social Security, Medicare, and state unemployment insurance. Employers must withhold these taxes from employees’ paychecks and are also responsible for paying certain portions of payroll taxes directly. Failing to comply with payroll tax obligations can lead to penalties, interest, and potentially serious legal consequences. We work closely with business owners to help them stay on top of these payroll responsibilities, avoiding issues with tax authorities and ensuring accurate reporting.

Misclassification of Workers

Worker classification is critical in determining tax responsibilities and legal obligations. Misclassification occurs when a business incorrectly categorizes a worker as an independent contractor instead of an employee or vice versa. This distinction is important because employers must withhold income taxes and pay payroll taxes for employees, whereas independent contractors handle their own tax obligations. Misclassifying workers can lead to IRS penalties, back taxes, and interest. We support clients by reviewing their worker classifications, ensuring that relationships align with IRS and Department of Labor standards, and helping them avoid the legal and financial impacts of misclassification.

Proper management of tax responsibilities and a clear understanding of business tax regulations are essential to reducing liabilities and avoiding penalties. If you’re seeking guidance from our tax lawyer in Bethesda, Maryland, to address business or individual tax concerns, contact Crepeau Mourges today to discuss your needs and learn how we can help.

Contact Our Tax Lawyer Today

Creating a small business tax strategy takes time and attention to detail, but it’s a critical part of running a successful business. We help business owners reduce their tax burden and make informed decisions that support their growth. Though we have our office in Maryland, we are also licensed to practice in Florida, Virginia, Pennsylvania, and the District of Columbia. Contact our Bethesda tax lawyer today to schedule a consultation and learn how we can work together to build a solid tax strategy for your business.

Client Review

“I have used Brian for several complicated tax issues including the sale of a company and issuance of restricted stock. He is incredibly knowledgeable, thoughtful and professional. I have recommended Brian to several people because of my experience, and in speaking with them they have all experienced the same level of service that I did, which is the best compliment ever.”

John Ferrara