Your Dedicated Tax Attorney

If you are being faced with a tax issue outside of your knowledge or experience, then hiring our Annapolis, MD tax lawyer is something you should consider. Hiring our Maryland tax lawyer is one of the ways you can avoid costly mistakes when you run into complex tax issues. These mistakes can truly add up and if you can avoid making them, then do. Now, if you are going about folding your regular tax return, then you likely won’t need the services of our lawyers. Many people can file their taxes and be just fine. However, there are times that you should consider our tax lawyer. Crepeau Mourges, our renowned law firm in Maryland, is dedicated to providing exceptional legal services to help clients manage their tax issues effectively. Contact us today to discuss your situation and learn how we can help.

How Our Tax Lawyer Can Help You

Crepeau Mourges offers a wide range of tax-related services. Our team is committed to making sure our clients receive comprehensive support tailored to their specific needs. Their areas of practice include:

- Tax Planning and Compliance: Crafting strategies to minimize tax liabilities and ensure adherence to federal, state, and local tax laws.

- Tax Controversy and Disputes: Representing clients in disputes with the IRS and other tax authorities, including audits, appeals, and litigation.

- Business Taxation: Advising businesses on tax planning, compliance, and dispute resolution, including issues related to mergers, acquisitions, and restructurings.

- Estate and Gift Taxation: Assisting clients with estate planning, wealth transfer strategies, and gift tax compliance to minimize tax burdens on heirs.

- International Taxation: Providing guidance on cross-border tax issues, including expatriation, foreign income reporting, and compliance with international tax treaties.

- Tax Fraud and Criminal Defense: Defending clients accused of tax fraud or facing criminal tax investigations and prosecutions.

- Employee Benefits and Executive Compensation: Advising on the tax implications of employee benefits, retirement plans, and executive compensation packages.

- State and Local Taxation: Navigating state and local tax regulations, including sales tax, property tax, and income tax matters.

- Nonprofit and Tax-Exempt Organizations: Assisting nonprofit organizations with obtaining and maintaining tax-exempt status, as well as compliance with related regulations.

If You Are Behind On Taxes

If you have yet to file tax returns for a certain year, then it’s no surprise to hear that the IRS is probably making your life miserable. Not only does the Internal Revenue Service continue to inflict penalties and interest on those who have back taxes, but they may go to great lengths to interfere with that person’s life. And, the IRS can file a tax return on a person’s behalf and make collection attempts on the amount due, even if it’s way more than what they would have owed in the first place.

Sometimes, the best route to handling such a tricky situation is to hire our lawyer who understands how the tax system works and can use this knowledge to your benefit. We understand that life can get hard, and you may not have the funds to shell out hundreds or thousands of dollars in taxes all at once. Especially in recent years with COVID and other worldly events, we may not have the financial footing that we would have had if the times were better.

How We Can Help

We routinely help clients in becoming compliant with the IRS and submitting any number of returns that are past due. We can assist you in getting this debt resolved and advocating for your behalf. When meeting with a member of our legal team, prospective clients may ask us what happens if they lost their income documentation. In most situations, it won’t pose a serious problem. We can locate and obtain your income and wages transcripts that show us the information we need to help.

Based on how many years of back taxes you have, you may need to do more than simply submit your tax returns. You may be happy to learn that you actually are entitled to a refund that you would have otherwise missed out on. But the only way to get a realistic picture of what handling back taxes will look like for you is to get help from our lawyers who can guide you through this process. Organizing your taxes may sound overwhelming, but it’s better to set it right and current so you can slowly pay them off instead of feeling the daily burden of back taxes you haven’t dealt with yet. If you aren’t sure if now is the time to finally get your overdue taxes handled, here are signs that you probably should:

- The stress of knowing you have back taxes causes you stress everyday

- The IRS keeps pestering you relentlessly

- You have received late penalties or other fees that just keep accruing

The IRS has begun collection efforts for your taxes (even if you haven’t filed the return yet)

Our tax lawyer is there to help you understand the complicated tax laws that come with these scenarios. Often they can help make your life a little easier, as you know you won’t have to be handing these things alone and risking an easy mistake. The laws are difficult to understand if you don’t have a background in them, but our lawyers do. This is why you shouldn’t ever handle a difficult tax issue on your own.

If you or someone you know is going through the need to find our tax lawyer in Annapolis, MD, then reach out to the team at Crepeau Mourges to find out what we can do to help you today.

Death And Taxes

Many people think that once an individual dies, so too does their obligation to pay the government anything in taxes. Unfortunately, this is often not the case. Any income tax that they owed the government while they were alive will still be owed even though they have died. There is also the potential for the decedent’s estate to now owe inheritance or estate taxes.

If a person is not well versed in tax law, knowing what types of taxes may be owed can be confusing. This is why it is always a smart idea to consult with our experienced Annapolis, MD tax lawyer to make sure that you and your family are fully protected from any issues the IRS may claim you have.

Filing Income Taxes for an Estate

When a person dies, one of the duties of the executor the estate must address is filing a tax return in order to report any income the decedent had earned during the time period from the last time they filed income taxes up to the day they died. If the decedent had failed to file tax returns for any prior years, the executor must also file returns for those years, as well.

As our Annapolis, MD tax lawyer can explain, when it comes to any back taxes the decedent owed to the IRS, there is a statute of limitation in place of how long the agency can pursue collection of those taxes. The agency has 10 years from the date the agency assessed that tax obligation. The IRS may also audit a decedent’s taxes after they have passed, however, there is a statute of limitation for that action, as well. They only have three years unless the return underreports the decedent’s income by 25 percent or more. In these cases, the statute of limitation is pushed to six years.

The executor is also required to report any income the estate itself may generate if that amount is more than $600 per year. For example, if the decedent owned rental property, the income that comes in each month in the form of rent needs to be reported to the IRS and taxes may need to be paid on that amount, depending on what type of deductions the estate is entitled to take. These taxes must be paid out of the estate before the estate is distributed to the heirs named in the decedent’s will.

Providing Solutions To Your Tax Issues

Crepeau Mourges provides tailored solutions to address the unique tax issues faced by individuals and businesses in Annapolis, MD. Their expertise and local knowledge ensure that clients receive effective and efficient resolution to their tax concerns.

- Personalized Tax Strategies – Understanding that every client’s tax situation is unique, we develop personalized tax strategies that align with individual financial goals and circumstances. Whether you are dealing with complex business transactions or personal tax matters, their customized approach ensures optimal results.

- Expert Audit Representation – Facing an IRS audit can be stressful and time-consuming. We offer experienced audit representation, guiding you through the process and protecting your rights. Their experienced attorneys handle all communications with the IRS, ensuring a thorough and professional response to audit inquiries.

- Effective Dispute Resolution – Tax disputes can arise from various issues, including discrepancies in tax returns, alleged underreporting of income, or disagreements over deductions. We specialize in resolving these disputes efficiently, whether through negotiation, mediation, or litigation.

- Comprehensive Compliance Services – Staying compliant with tax laws is crucial to avoid penalties and interest. We assist clients in maintaining compliance through accurate and timely filing of tax returns and other required documentation. Their proactive approach helps prevent future tax issues and ensures peace of mind.

- Strategic Tax Planning – Effective tax planning can lead to significant savings and a reduction in tax liabilities. Our attorneys work with clients to develop strategic tax plans that take advantage of available deductions, credits, and tax incentives, ensuring optimal tax outcomes.

- Defense Against Tax Fraud Allegations – If you are accused of tax fraud, it is essential to have a strong legal defense. We provide robust representation for clients facing criminal tax investigations, working diligently to protect your rights and achieve the best possible outcome.

- Assistance With Complex Transactions – Business transactions, especially those involving mergers, acquisitions, or international dealings, can have significant tax implications. We offer specialized guidance on structuring these transactions to minimize tax liabilities and ensure compliance with relevant laws.

Common Myths About Taxes

As most people know, paying taxes is just a part of life. However, that doesn’t mean that dealing with your taxes and the Internal Revenue Service (IRS) can’t be confusing. There’s certainly a lot of misinformation. Here are a few common myths about taxes that you shouldn’t believe.

People always go to jail for unpaid taxes

Unfortunately, this is one of the most common misconceptions about taxes. While owing taxes can be quite stressful, it usually won’t land you in jail. If you simply forget to file your taxes or pay them late, the IRS likely won’t criminally prosecute you. People can, however, face jail time if they knowingly commit tax evasion. Although you might not be sentenced to jail for not paying your taxes, you can face other penalties, like fines.

If you owe back taxes, entering into a payment plan is your only option

Payment plans are certainly a common way to deal with tax debt, but they aren’t the only option. If you have tax debts, you may qualify for certain programs. For instance, may be eligible for an Offer in Compromise, which allows you to pay your tax debt for less than you know. Our experienced tax lawyer can inform you of all your options.

If you file an extension, you have more time to pay your taxes

This isn’t true either. Filing an extension just gives you more time to file your taxes, not additional time to pay them. If you don’t pay your taxes by the deadline, you may receive penalties.

You can claim your pets as dependents

Although you may think of your pets as members of your family, you are not allowed to claim them on your taxes. Pets are considered property under the eyes of the law. Attempting to claim on your taxes can be considered fraud.

If you don’t make a high income, you can’t get audited

Some people assume that they can only get audited by the IRS if they make a six-figure salary. This just isn’t the case. Even if you don’t make a lot of money, the IRS would audit you if they notice red flags.

Your tax preparer is responsible for mistakes on your tax returns

Even if you hire a professional to prepare your taxes, you will be the one liable for errors on your return. As such, you should double check the paperwork for any mistakes.

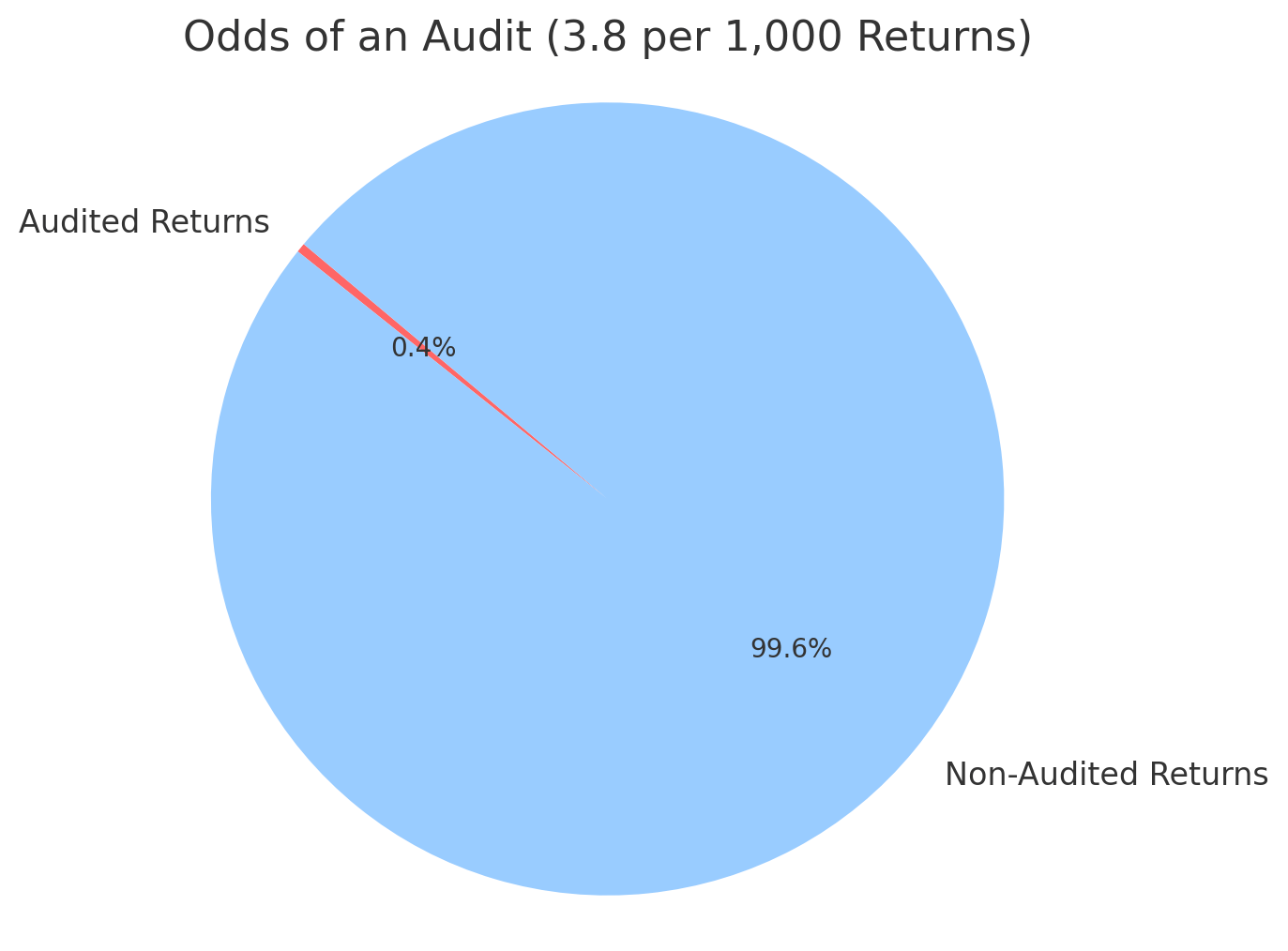

Annapolis Tax Law Infographic

Annapolis Tax Law Statistics

According to national statistics, in 2022, more than 164 million individual income tax returns were filed. The IRS audited 626,204 returns, down from 659,003 during FY 2021. Less than 100,000 of these were regular audits in contrast to correspondence audits. Together, this means that last year, the odds of an audit had fallen to 3.8 out of every 1,000 returns filed. If you have been notified that you are being audited, contact our tax lawyer immediately.

Annapolis Tax Law FAQs

What Should I Look For In A Tax Attorney?

When choosing a tax attorney, consider their experience, expertise in tax law, and track record of successful outcomes. Look for someone who provides personalized service, communicates clearly, and has a deep understanding of your specific tax issues.

How Can An Attorney Help With An IRS Audit?

Our tax attorney can represent you during an IRS audit, ensuring that your rights are protected and that the process is handled professionally. They can help gather necessary documentation, respond to IRS inquiries, and negotiate any potential settlements or payment plans.

What Are The Benefits Of Tax Planning?

Tax planning helps you minimize your tax liabilities, ensuring compliance with tax laws while maximizing financial benefits. Effective tax planning can lead to significant savings and reduce the risk of penalties or legal issues.

Can A Lawyer Help With International Tax Issues?

Yes, our tax attorneys at Crepeau Mourges can help with international taxation matters. They can assist with issues such as expatriation, foreign income reporting, and compliance with international tax treaties, helping you navigate the complexities of cross-border tax laws.

What Should I Do If I’m Accused Of Tax Fraud?

If you’re accused of tax fraud, it’s crucial to seek legal representation immediately. Our tax attorney can provide a strong defense, help you understand the charges, and work towards the best possible outcome for your case.

Will The IRS Negotiate The Amount Of Money I Owe In Taxes?

The IRS does have an option called an “offer in compromise” that can help you to settle your tax debt for a fraction of the amount you actually owe. In order to apply, you must first fill out a Form 656-B, which can be found on the IRS website. Eligibility requirements include an inability to pay the full amount owed without creating an undue economic hardship, such as losing your only place to live. The IRS also takes into account your income, expenses, and assets. Based on the IRS determination, they may settle with you if they do not believe they will be paid the full amount in a reasonable time period.

My Tax Audit Made Me Fall Behind On My Taxes. Why Did I Get Audited?

It is not always clear why the IRS chooses to audit people. The IRS sometimes audits at random, but most of the time it is due to something that looks suspicious on a person’s taxes. Suspicious activity can include failing to report all of your income, running a cash-based business and not filing appropriately, using round numbers or even claiming too much charitable giving. Other times, the oddities can simply be the result of a mistake. If you are being audited, especially if it puts you behind on your taxes, it is a good idea to consult our Annapolis tax lawyer.

I Already Know I Cannot Afford My Taxes. What Should I Do?

Even if you cannot afford your taxes, it is a good idea to file them anyway, since not filing can be a criminal offense. Additionally, not filing by the deadline can lead to an additional financial penalty. After filing, contact our Annapolis, MD tax lawyer for options. The options available may include requesting a payment plan from the IRS, requesting to delay payment, or agreeing to an offer in compromise.

What Can The IRS Levy From Me If I Cannot Pay Back What I Owe?

The IRS is legally allowed to seize your property if you are unable to pay your taxes. They may also garnish your wages, which means they will take a certain percentage, usually up to 25%. They can also seize money already in your bank account or sell some of your valuable assets, such as vehicles. But the good news is that this will not come as a surprise. The IRS will notify you of their intent. If you have already received a Final Notice of Intent to Levy and Notice of Your Right to A Hearing, you have limited time to find a solution, and you should consider contacting our Annapolis, MD tax lawyer immediately.

Are There Types Of Income the IRS Cannot Seize?

While the IRS can seize many types of income such as wages, salaries, and interest, there are some types they cannot seize. These include child support and foster care benefits. They are also not allowed to seize various veterans benefits or combat pay. If you are receiving worker’s compensation for an accident, they are not able to levy those funds to pay your taxes.

Annapolis Tax Law Glossary

When dealing with tax matters, understanding key terms can make a significant difference in how you approach your situation. Our Annapolis, MD tax lawyer at Crepeau Mourges provides clear, practical guidance on tax law matters, ensuring our clients have the knowledge they need to make informed decisions. Below are important terms related to tax law that frequently arise in our practice.

Tax Assessment

A tax assessment is the formal determination of the amount of tax owed by a taxpayer. This can be issued by the Internal Revenue Service (IRS) or state tax agencies based on reported income, deductions, and credits. If an individual or business disagrees with an assessment, there are options to challenge it, including requesting an abatement or filing an appeal.

Offer In Compromise (OIC)

An Offer in Compromise is a negotiated agreement between a taxpayer and the IRS that allows the taxpayer to settle their tax debt for less than the full amount owed. The IRS considers factors such as income, expenses, assets, and the taxpayer’s ability to pay before approving an OIC. Not all taxpayers qualify, and submitting a well-prepared application with legal assistance can increase the likelihood of acceptance.

Tax Lien

A tax lien is a legal claim by the government against a taxpayer’s property due to unpaid tax debt. This lien can affect real estate, personal property, and financial assets. If left unresolved, it can negatively impact credit scores and financial stability. Resolving a tax lien may require full payment, an installment agreement, or an appeal to remove the lien if it was improperly filed.

Tax Levy

A tax levy is the legal seizure of assets by the IRS or state tax authorities to satisfy unpaid tax debt. Unlike a lien, which serves as a claim, a levy results in actual asset seizure, such as wage garnishments, bank account withdrawals, or property confiscation. Taxpayers have limited time to respond once a levy is issued, making it essential to seek legal guidance to explore available options, such as an appeal or payment arrangement.

IRS Audit Representation

IRS audit representation involves legal support during an audit conducted by the Internal Revenue Service. A tax attorney can communicate with the IRS on a taxpayer’s behalf, gather necessary documentation, and negotiate any adjustments to minimize financial impact. Having legal representation can significantly improve outcomes and protect taxpayers from potential penalties.

Payroll Tax Liability

Payroll tax liability refers to the employer’s responsibility to withhold and remit employee payroll taxes, including Social Security, Medicare, and income tax withholdings. Failure to properly manage payroll taxes can lead to severe penalties, including personal liability for business owners or officers under the Trust Fund Recovery Penalty. Proper legal guidance can help businesses stay compliant and resolve payroll tax disputes effectively.

Foreign Bank Account Report (FBAR) Compliance

FBAR compliance requires U.S. taxpayers with foreign financial accounts exceeding $10,000 at any point during the tax year to report these accounts to the Financial Crimes Enforcement Network (FinCEN). Failure to comply with FBAR requirements can result in substantial penalties. Tax attorneys assist clients in navigating foreign account disclosures and resolving past non-compliance through voluntary disclosure programs.

State And Local Tax (SALT) Deductions

State and Local Tax (SALT) deductions allow taxpayers to deduct state and local income, sales, and property taxes on their federal tax return, subject to limits set by the IRS. Changes in tax laws have placed caps on these deductions, affecting taxpayers in high-tax states. Understanding the impact of SALT deductions can help individuals and businesses strategize their tax filings effectively.

Withholding Tax Errors

Withholding tax errors occur when employers incorrectly withhold income taxes from employees’ wages. Errors can lead to underpayment or overpayment of taxes, requiring adjustments or corrections. Employers must stay informed about withholding requirements to avoid compliance issues.

Contact Our Annapolis Tax Lawyer Today

Tax law procedures require experience, dedication, and a personalized approach. Crepeau Mourges in Annapolis, Maryland, offers all of these qualities and more. Let us be your trusted partner for when you’re facing tax challenges. Contact our firm today to set up a time to discuss your case and goals.